Real estate is the largest asset class in the world. Commercial real estate in the US has a market size of $17 trillion while single-family residential homes in the US have a market size of $36 trillion.

Real estate is the largest asset class in the world. Commercial real estate in the US has a market size of $17 trillion while single-family residential homes in the US have a market size of $36 trillion.

Why Invest In Real Estate?

Due to its sheer size, every major institutional fund has some allocation to real estate. For any sophisticated investor (or $1 billion+ fund), diversification and benefits from risk parity become crucial to portfolio management. Zillow also expects more pronounced growth in 2021 as sustained demand pushes asset prices higher combined with a lower cost of capital. The 2020 US housing market gains were also the largest in the last 15 years.

How To Gain Real Estate Exposure In Your Portfolio?

There are multiple methods of investing in real estate. We can broadly categorize them as being through public markets or private markets, and equity or debt.

Private Equity

Private Equity

When individuals buy real estate for themselves or engage in fix & flip projects, they engage in private equity. At the institutional level, these projects would be building major apartment complexes, malls, or hotels.

Private Debt

Respectively, individuals engaging in private equity need financing. For residential projects, that is usually from a bank. The bank provides a loan with terms based on the creditworthiness of the borrower and uses the property as collateral for the loan.

Public Equity

Public equity in real estate exists predominantly through REITs. In 1960, REITs were created as a way for individuals to own shares in commercial real estate portfolios–which was previously only possible for wealthy individuals. One way of understanding this is to think of REITs as public companies on the stock exchange from which you can buy ownership at $10 per share- the difference being REITs only invest in real estate. There are over a dozen types of REITs, including retail, residential, healthcare, and office REITs. They could behave as classic asset managers or they could be master-planned communities. Moreover, due to the strong dividend income REITs provide, they are an important investment both for retirement savers and for retirees who require a continuing income stream to meet their living expenses.

Private Debt

When a loan is financed by a bank, that loan stays on its balance sheet–which in turn reduces its ability to originate more loans. In order to originate more loans (and collect fees), banks sell off these loans in the form of mortgage-backed securities (MBS).

For residential loans, a commercial bank would acquire a large pool of loans, group them all together, and securitize them–making them into an investable product for the open marketplace. MBS are often made into other structured products such as CLOs, CDOs, and SIVs. Therefore, although they are technically “public debt” (since anyone can invest), your everyday individual is not able to invest as each slice of MBS requires a minimum investment of $10m. Investors of MBS are generally pension funds, insurance companies, and banks.

Real Estate Opportunities Vs. Costs

When the average person invests in real estate, he/she typically turns to fix & flip or other private equity projects. This category provides a broad degree of agency and allows investors to choose any location or project and structure it however they would like. For commercial real estate, institutions generally choose between core, value-add, or opportunistic projects.

Equity investments have a higher potential return on investments than debt investments. In a debt investment, the maximum return on investment is the interest rate whereas the value of physical real estate property can increase without end. For example, if someone finds an appealing fix & flip project, he/she could make a 40% ROI in one year whereas the bank financing this project will only earn the 12% interest rate that was placed on this loan. However, debt instruments can be considered “safer” as if the borrower defaults, the debt holder obtains the property. The right debt instrument would mean an expected return equal to the interest rate as well as a default upside.

REITs (and some MBS) benefit from being liquid.

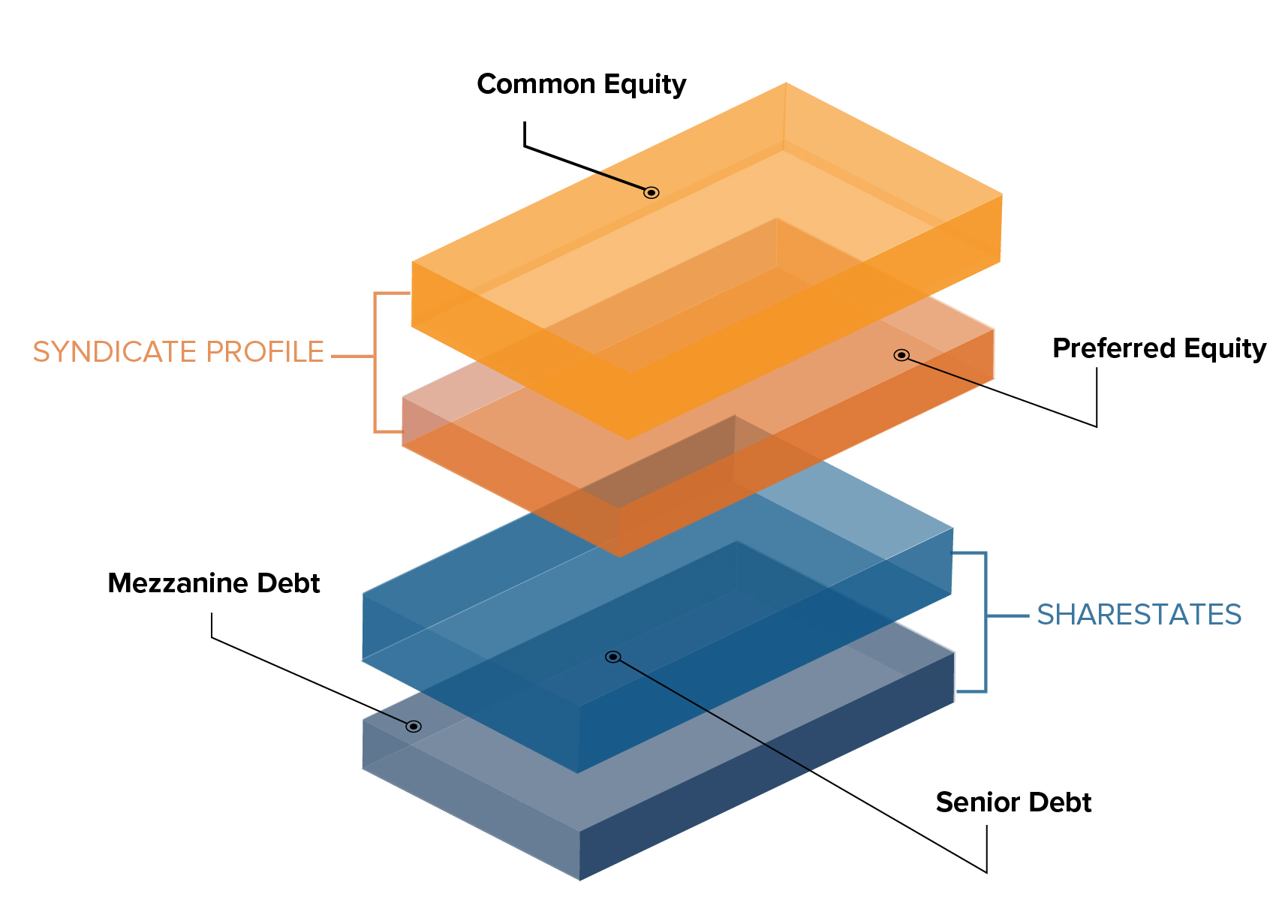

Where Does Sharestates Fall?

Banks primarily act as the financiers of private debt for residential projects. While this is true for term loans (refinance, purchases), fix & flip deals fall within the privy of hard money loans, which are not funded by banks. Sharestates engages in funding both term and bridge hard money loans and offers these loans to accredited retail investors, allowing them access to a market that would ordinarily have a huge wealth requirement as a barrier to entry.

Retail investors in Sharestates also have agency and can pick and select the loans they believe are most promising. Done correctly, investors have a base case scenario where the expected return is the interest rate. In the worst-case scenario, the risk is mitigated if a borrower defaults and the property is worth more than the expected payments on the loan. Sharestates’ underwriting standards are, thus, critical to both our borrowers’ and investors’ mutual success.