If you’re considering fixing and flipping a house, there’s a great deal to consider to ensure you’re making a wise real estate investment. One of the key metrics is ARV. This article addresses everything you need to know about ARV in real estate.

What is ARV in Real Estate?

ARV stands for After Repair Value. It is a measure of the future value of a property after renovations. It’s used primarily in house flipping, where an investor buys a distressed house, fixes it, and then sells it. This is often done within a few months or up to a year.

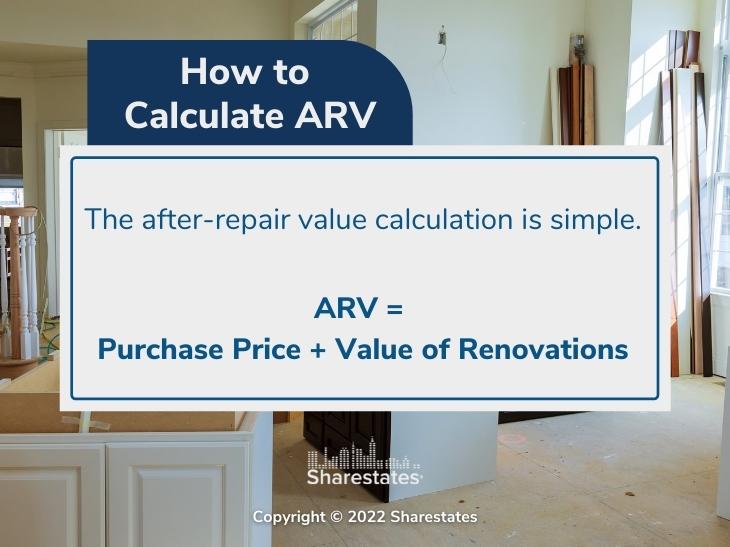

How to Calculate ARV

The after-repair value calculation is simple.

ARV = Purchase Price + Value of Renovations

The purchase price is exactly the amount paid for the property. The challenge is determining the value of the renovations.

How to Determine the Value of Renovations

You already know the purchase price. The next step is to determine the value of renovations. That can be pretty straightforward yet not entirely without risks. There are two primary ways to get at the value after renovations: evaluate comparable properties and property appraisal.

Evaluate Comparable Properties

Comparable properties are those that are similar to the investment property. They should be near the same age, square footage, room count, and neighborhood. Ideally, they will have sold in the last few months and be within a few miles. MLS listings can be very helpful in compiling the needed information on recently sold homes.

Property Appraisal

As you can tell from the comparable property evaluation, you’re extrapolating from recent sales and attempting to apply them to the investment property under consideration. Another option is to conduct an appraisal. Hiring an appraiser can give you a better idea of the potential value. It can also provide insight into any problems they may find with the property.

ARV Calculation Example

The ARV is the number you arrive at from a comparable property evaluation or a property appraisal from those evaluations. For example, if a comparable 2,500-square-foot home with most of the anticipated improvements for the investment property were recently sold at $250,000, the price per square foot would be $100. If the investment property’s square footage is 2,000, the expected sales price would be $200,000.

This value is the maximum sales price you can expect and therefore has the original purchase price and the value of renovation included. Given that, this is the After Repair Value.

Digging just a bit deeper, if the purchase price is $120,000, then the value of renovations is $80,000. The goal then is to keep the cost of those renovations well below that amount. You also need to factor in loan costs, closing costs, and administrative fees when analyzing any potential real estate deal. It’s wise to follow the 70% rule.

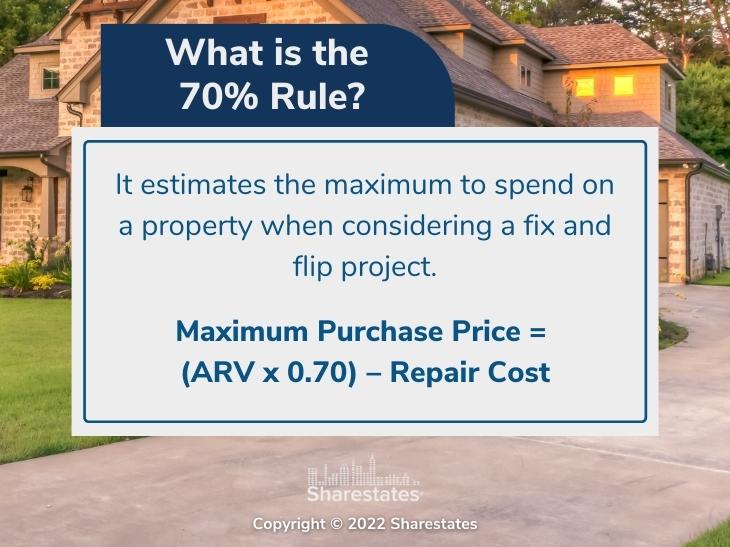

What is the 70% Rule?

While the 70% rule isn’t carved in stone, it is a good rule of thumb when considering real estate investments. It estimates the maximum to spend on a property when considering a fix and flip project. Here’s the formula.

Maximum Purchase Price = (ARV x 0.70) – Repair Cost

Returning to our example above, an ARV of $200,000 times 0.70 equals $140,000 minus the expected repair cost. In our case above, with a purchase price of $120,000, the expected repair cost can’t exceed $20,000 to stay within the 70% rule amount of $140,000.

Types of Loans for Real Estate

The two primary sources of loans for real estate are bank loans and private loans. When it comes to fixing and flipping properties, banks generally stay away from providing loans due to the generally poor condition of the property and the risk inherent in the repair process. That leaves private loans designed to match investors with real estate projects.

We’ve provided a brief guide to private real estate loans. It includes details on what you need to do to secure a private loan. It would also be worthwhile to review our article on the pros and cons of private real estate loans. You can generally expect lower down payments, a simpler qualification process, and more flexible repayment terms. But you can also expect higher interest rates, shorter terms, and limited regulation. That latter allows all the flexible arrangements but, as a result, offers fewer legal protections.

These loans are generally called hard money loans and include short-term bridge loans and rehab loans.

That’s a reasonably deep discussion of the ARV or after repair value. We hope this review of ARV in real estate has helped provide insight into real estate financing. To learn more about getting funding for your business through Sharestates, click here.