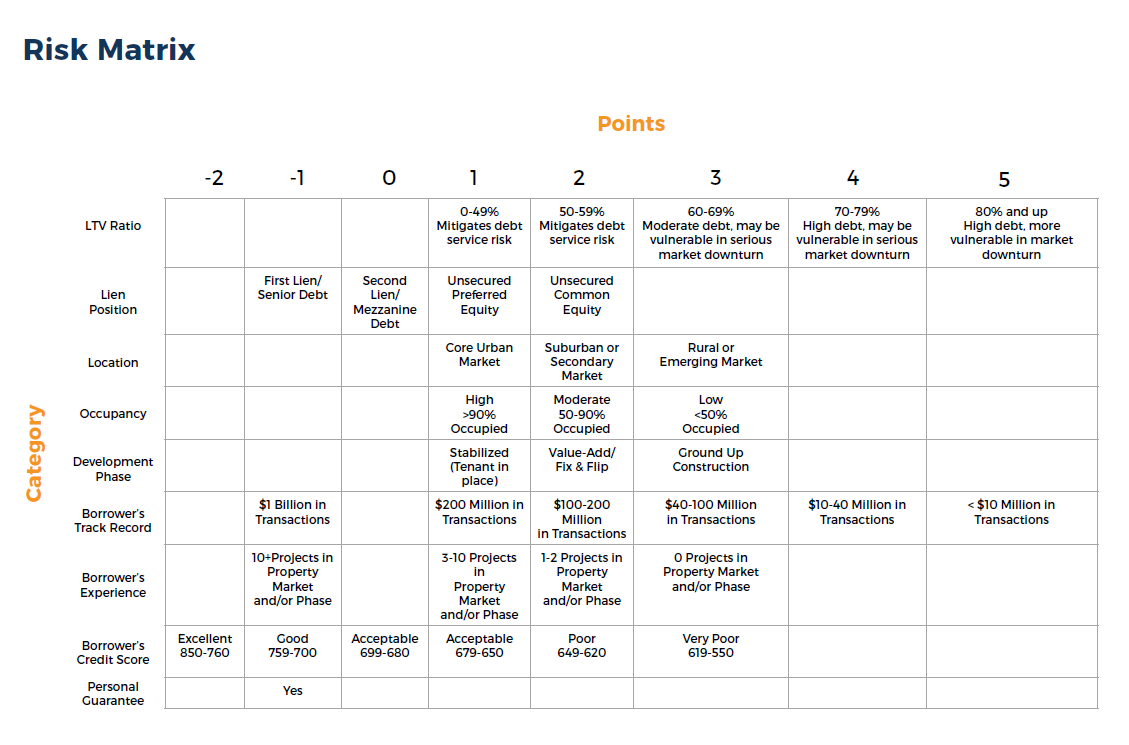

to know exactly what factors go into determining the risk of a Sharestates deal? This determined risk helps to create an estimated percent for your gross annual ROI (return of investment); making the Risk Matrix one of the most important tools we use.

Underwriting a Real Estate Crowdfunding Deal

The Risk Matrix is applied to each and every Sharestates Real Estate Property. This matrix helps us to determine a grade for the property which will provide us with the estimated return that is given to the investors.

First, let’s look at the Risk Matrix (best viewed in desktop):

As you can see on the left side of the matrix, there are nine categories from which we gather risk points. Assessment in each category will yield a risk point value. The sum of points in all nine categories will render the letter grade that you see in the risk rating section of the investment project summary.

- A credit score of 680 (0 points)

- Completed 8 previous projects in similar markets (1 point)

- A track record of $200 million (1 point)

- Our personal guarantee (hint: all of our approved borrowers will have our personal guarantee) (-1 point)

And if the property is…

- A value-add (2 points)

- In first lien (-1 point)

- A high occupancy (1 point)

- An LTV of 37% (1 point)

- Located in an Urban Market (1 point)

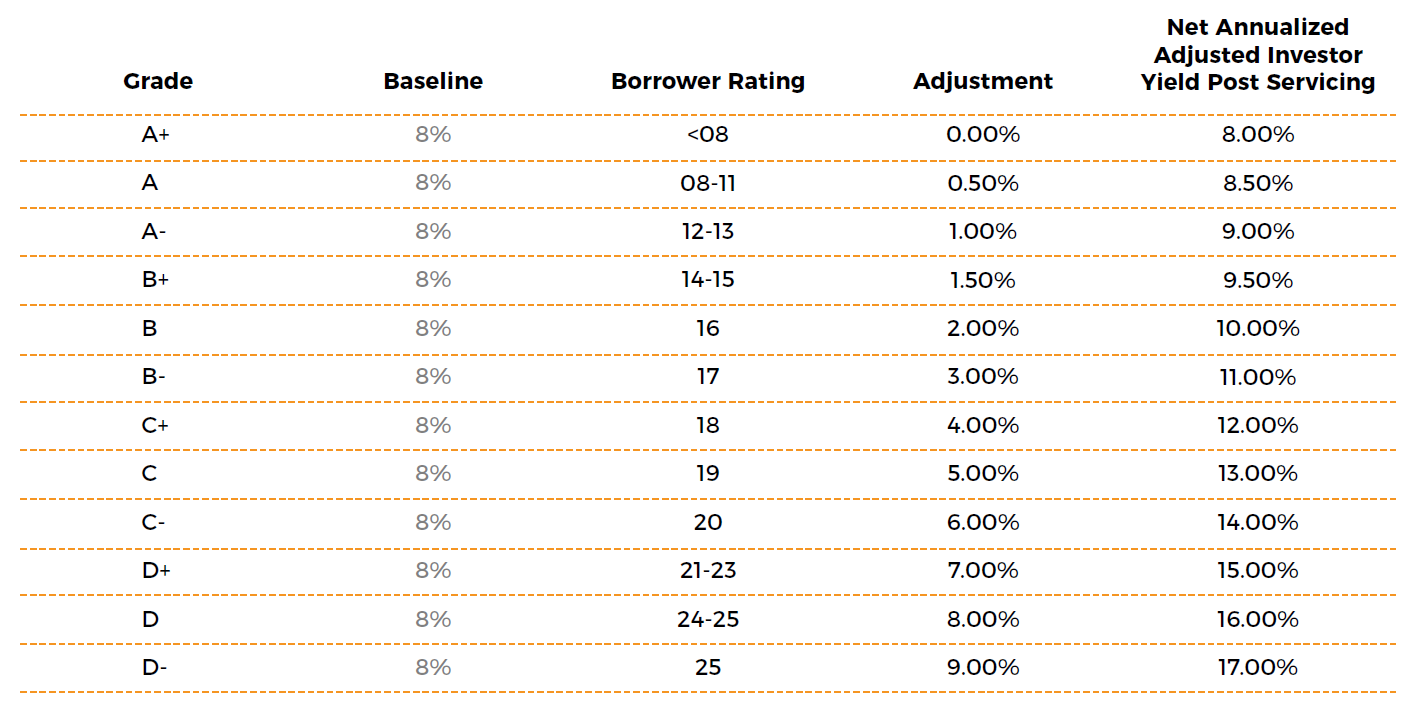

Then this property has a total of 5 points.

We can see that 5 points will give us a grade of A+. The baseline interest starts at 8%. There is 0% adjustment. If you were to invest in this property, your estimated gross annual ROI will be 8%. The higher the risk associated with the investment property, the higher your estimated ROI will be.