FAQ - General

Browse our frequently asked questions

Sharestates will provide you with the right information and tools. If your question is not covered, please get in touch with us and we will connect with you.

For borrower and investor FAQs, please click on the buttons below.

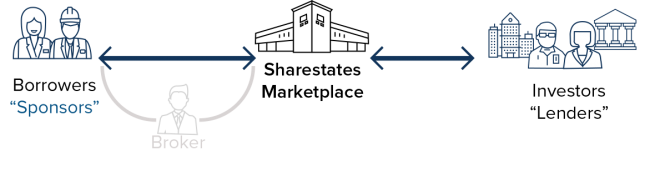

Sharestates is an online marketplace lending and investing platform, also known as real estate crowdfunding. We connect private investors and institutions with real estate developers and owners who want to raise capital for their real estate projects. Sharestates offers developers (real estate sponsors and property owners) access to real estate capital much faster than traditional funding sources while providing investors with the high (8-12%) returns on asset-backed real estate debt investments.

To learn more, visit our how it works web pages for real estate investors or developers.

Sharestates was founded in August 2013 by Allen Shayanfekr with brothers Radni Davoodi and Raymond Y. Davoodi. Sharestates launched in July 2014 and began originating loans in 2015.

Reg D, Rule 506c allows Sharestates to raise an unlimited amount of money for real estate projects we feature in our marketplace as long as we meet two conditions:

- All investors are accredited investors

- We take necessary steps to ensure all investors who participate are accredited investors.

Sharestates includes a request for accredited investor status during the registration process. We then verify investor documentation to ensure compliance with Rule 506c of Reg D.

Under this rule, Sharestates is not required to register real estate projects we feature with the SEC, however, we are required to submit Form D. You can see all Sharestates SEC filings in the EDGAR database. No State or Federal regulatory body has passed upon or endorsed these offerings.

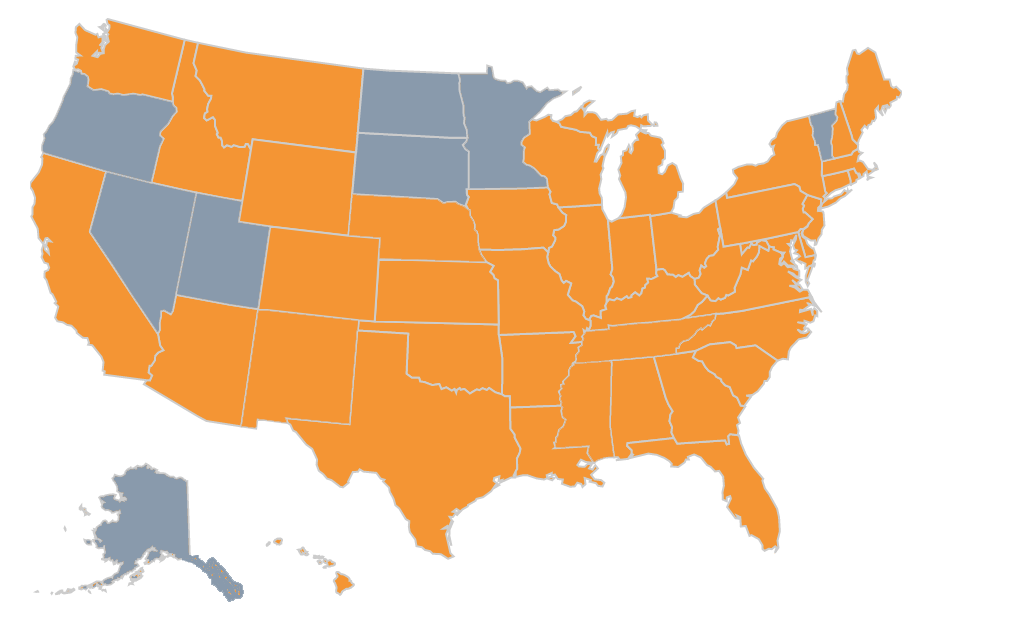

Sharestates lends across the United States, covering 42 states excluding Alaska, Minnesota, Nevada, North Dakota, South Dakota, Oregon, Utah, and Vermont.

It’s easy to get started with Sharestates. Register online at www.sharestates.com. The two-step process takes less than a minute.

When you register, you can choose between an investor account or a sponsor account. Your profile settings will be based on the type of account you set up. If you register as an investor, you can link a bank account to your profile and choose which features you want for your account. As a sponsor, you can upload real estate projects for review straight from your profile.

Marketplace lending uses online platforms to connect borrowers with investors willing to offer loans. It offers both new loans and refinancing.

A worldwide industry has developed to launch and expand these platforms. In 2017 alone, according to Fintech Global, venture capital firms invested $8.9 billion in 233 deals related to lending platforms.

That’s because a lot of money is flowing through these sites — enough to attract the attention of some of the world’s largest banks. No less a player than Goldman Sachs has established its own marketplace lending platform.

Transparency Market Research reports that, in 2015, this channel accounted for $26.2 billion in loans worldwide, a little under half of which were in the U.S. If the study’s projected 48.2% annual growth rate holds up, worldwide platforms like these will have the $1 trillion mark in their sights by the end of 2024.

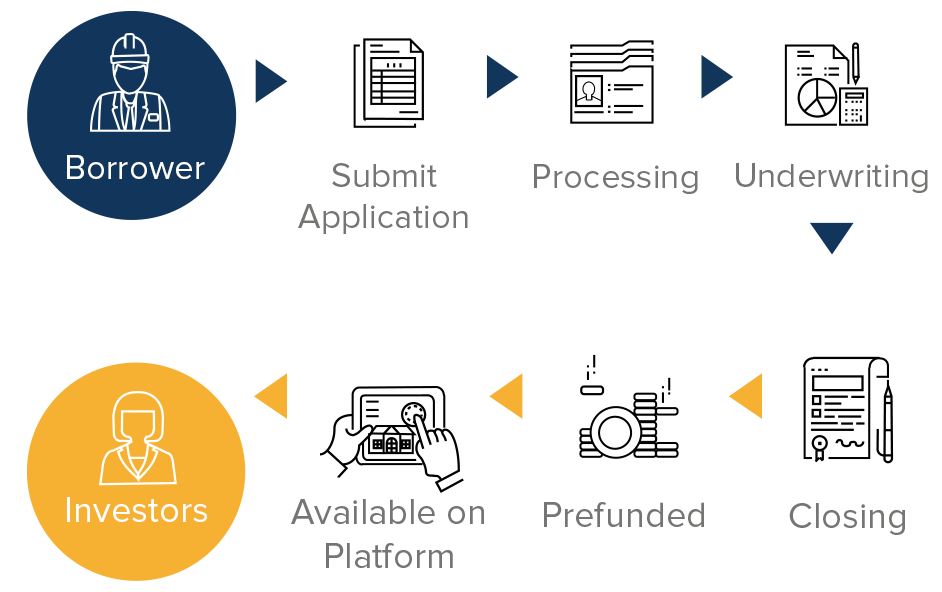

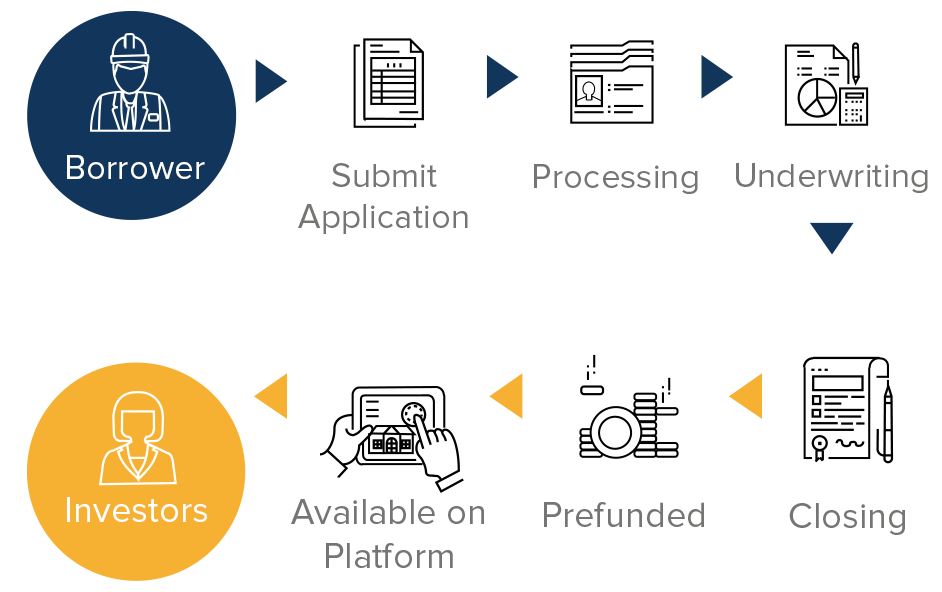

Lending process:

Peer-to-peer vs. marketplace lending

“Peer-to-peer” or “P2P” lending is a related term that isn’t used much anymore in countries with well-developed financial industries. When platform lending was new, part of its appeal was that it allowed individuals with only hundreds or thousands of dollars to invest to make loans to other people — peers — who wanted to borrow similar amounts. Over the years, banks and other major institutions became more active, crowding out true P2P lending. Although some developing economies still have robust P2P platforms, Sharestates is one of only a few remaining in the U.S. through which retail investors participate on par with institutional investors.

Balance-sheet vs. marketplace lending

The borrower’s income and creditworthiness form the basis for marketplace lending terms. Applicants prove these through tax or bank records or provide a forward-looking business plan. In some cases, lenders make decisions based entirely on the borrower’s self-declared statement. This differs from balance-sheet lending, which is another form of platform lending. Balance-sheet lending involves putting a lien on a property — an asset on the balance sheet.

To learn more about marketplace lending, click here for the glossary entry.

Real estate crowdfunding is the pooling of multiple investors’ money for projects related to the sale or improvement of land or buildings.

Sharestates is one of the leading platforms of this kind in the U.S. It focuses on raising debt investment for real estate projects, through its Shareline correspondent lending solution as well as a direct lending model.

Still, crowdfunding — for real estate investment or any other commercial purpose — can apply anywhere on the capital stack. That’s why Sharestates’ sister company, Syndicate Profile, offers equity investment opportunities.

Lending process:

Crowdfunding broadly

Crowdfunding is the practice of getting a large group of people to finance a project by using a website or other online tool to solicit funds.

Wordspy dates the first use of “crowdfunding” to 2006, but the concept goes far back into history. Because of this, subscription services, charitable donation drives and war bond issues all share similar traits to crowdfunding and clearly pre-date the internet.

A recent Technavio report estimates crowdfunding raised $43.5 billion in 2017 and is growing at a 17% annual growth rate.

Evolution of real estate crowdfunding

Real estate investment trusts (REITs) served the same purpose and long pre-date crowdfunding. Crowdfunding platforms now offer such advantages as a lower buy-in for retail investors and greater transparency into the underlying properties.

While it’s true that crowdfunding is a Web-native application, there’s more to it than technology. The law had to catch up with the hardware and network protocols. In the U.S., the Jumpstart Our Business Startups (JOBS) Act of 2012 fueled crowdfunding’s growth. The JOBS Act allows small businesses to solicit funds more publicly than they legally could for decades.

To learn more about real estate crowdfunding, click here for the glossary entry.

Browse our investor and borrower FAQs

Learn more about who we are and what our story is.

We take pride in our numbers. Take a look at our statistics and trends.

Your data-backed partner

We take pride in our numbers. Take a look at our statistics and trends.

Get in touch with us.

We are here for customer support, questions about getting started or to say hello!