If you’re considering entering the “fix-it and flip-it” business, you’ll need financing to buy and repair those properties. One excellent approach is a private real estate loan. In this article, we provide insight into what it is, the pros and cons, as well as when to use private real estate loans.

Private Real Estate Loans Defined

Private real estate loans, aka “hard money,” are provided by private investors or lending companies. These private investors loan real estate buyers the money needed to purchase a property. While this is a role similar to a traditional mortgage company, there are some significant differences.

Private real estate loans still need to set up a mortgage note or contract. Plus, they will specify the property for collateral, the term of the loan, and principal and interest payments. However, they are not subject to the laws and regulations that apply to traditional banks and mortgage lenders. This allows them much more flexibility in their arrangements with borrowers.

We’ve outlined the further distinctions between traditional mortgage loans and private loans in the discussion of pros and cons below.

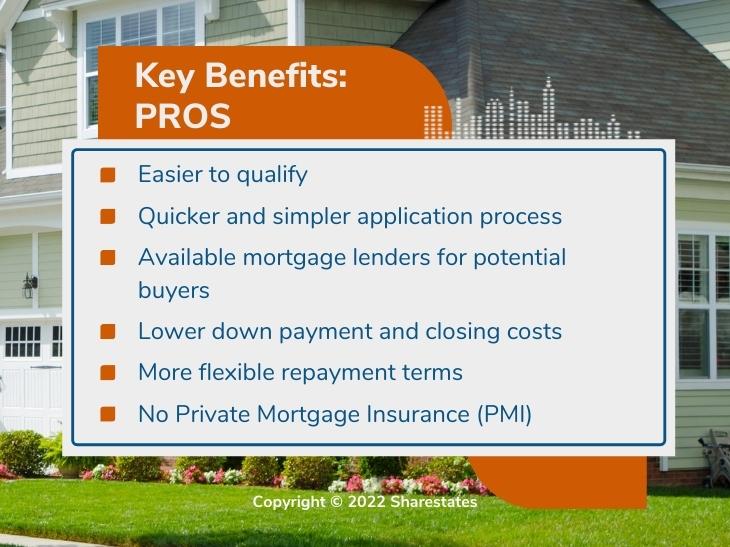

Private Real Estate Loans Pros

There are quite a few advantages to securing a private real estate loan. Here are the key benefits.

- Easier to Qualify. A low credit rating can often stand in the way of obtaining a traditional mortgage loan. In addition, if you’re self-employed and have difficulty demonstrating consistent income from IRS W-2 forms or other documentation, that too can disqualify you from a traditional mortgage. That’s where private real estate loans come into their own. They can set their own lending criteria and qualification requirements as well as any other aspect of making a loan.

- Quicker and Simpler Application Process. Private loans can be created in a manner of days. This is due to a simpler application process and qualifying requirements as well as less paperwork and approvals. Faster approval means you can quickly have cash in hand to close on a property.

- Lower Down Payment and Closing Costs. In general, there are fewer fees required for a private loan, which lowers closing costs. In addition, private lenders typically require lower down payments than traditional mortgages.

- More Flexible Repayment Terms. Private lenders can also be much more flexible in setting up repayment terms. For example, they can do interest-only payments or balloon payments at the end of the term. Given that, they can more readily meet your specific loan needs.

- No Private Mortgage Insurance (PMI). This type of mortgage insurance is required for traditional mortgages when borrowers put less than 20% down. This is not a requirement with private real estate loans.

Private Real Estate Loans Cons

As with all things, along with the benefits comes a few disadvantages. Here are the key disadvantages.

- Higher Interest Rates. Private lending is a business with investors who are seeking returns. In return for taking on higher risk, they receive higher interest payments. That’s definitely an advantage for the lender, but also one of the trade-offs for the borrower.

- Shorter Loan Terms. Traditional mortgages have 15-to-30-year terms. Private lenders are more likely to seek six months to three years for repayment. This arrangement can work well if you intend to fix a property and sell it quickly.

- Limited Regulation. In contrast to traditional mortgage lenders, there is no specific federal agency that oversees private lenders. That’s one reason they have more flexibility in their approach to making loans. But it also means there’s no one to go to when legal issues arise other than attorneys and the court system.

When to Use Private Real Estate Loans

Private real estate loans are great for fixing and flipping a property. The lenders are usually quite familiar with the needs of the typical borrower. They can, as result, tailor their loan terms and overall approach to better meet the needs of real estate investors.

Further, they can often finance both the purchase of the property and the costs of the needed renovations. That’s a real advantage for a fix-it and flip-it business.

We hope this brief review has helped provide insight into private real estate loans. To learn more about getting funding for your business through Sharestates, click here.