FAQ – Investors

Providing transparency across your investment journey

Browse our frequently asked investment questions and how Sharestates can provide you with the right information and tools to start your investment journey. Ready to get started? Our Private Client Relations team is ready to help your money start doing the work for you.

For U.S. investors, investment minimums start at $5,000 per investment.

For a non-U.S. investor, our investment minimums are $10,000 per investment.

U.S. Investors

Currently, real estate investing opportunities at Sharestates are open only to accredited investors and foreign non-U.S. investors.

The SEC defines an accredited investor as a high net worth individual with total assets equal to $1 million or more, either alone or with one’s spouse, outside of one’s personal residence, or whose earned income equaled $200,000 (or $300,000 with a spouse) in each of the previous two years with the expectation that the current year’s income will be the same or higher.

For institutional investors, an accredited investor is one with assets in excess of $5 million as long as the institution was not formed specifically for the purchase of the target security and as long as the target security is purchased by a sophisticated investor or all equity owners of the institution are accredited investors.

As of 2021, the SEC has updated the definition of an accredited investor to include the following:

Individual Accredited Investors

- Maintain in good standing their Series 7, 82, or 65 licenses

- Brokers, Advisers, and Private Placement Reps

- Hold and maintain in good standing a specific, verifiable professional certification, designation, or credential as designated by the SEC via Commission Order

- These appear to be case by case

- Are a “knowledgeable employee” of a private-fund issuer of securities as defined under rule 3c-5(a)(4) of the Investment Company Act

- an executive officer, director, trustee, general partner, advisory board member, or similar, of the private fund or an affiliated management person, or an employee of the fund or “affiliated management person” who participates in investment activities

The ruling also expanded the definition to include certain entities:

- SEC- and state-registered investment advisers and exempt reporting advisers under Section 203(m) or Section 203(l) of the Advisers act

- IA based in the US with $150mm under management and all clients are private funds

- Rural Business Investment Companies as defined under Section 384A of the Consolidated Farm and Rural Development Act

- LLCs, other corporate entities

- LLCs with at least $5 million in assets

- Any entity owning “investments” in excess of $5 million, with “investments” being defined in Rule 2a51-1(b) of the Investment Company Act

- Securities, cash, real estate, cash alternatives, commodities, basically anything that’s normally considered an investment

- Certain family offices as defined in the “family office rule” under 17 CFR § 275.202(a)(11)(G)-1 with at least $5 million in assets under management

- IAs with only family clients, grandfathered clients notwithstanding

Non-U.S. Investors

Sharestates is open to foreign investors (also known as “non-U.S. persons”). To be eligible to invest as a non-U.S. person, you must

- Complete a W-8BEN (for an individual) or W-8BEN-E (for entities) form*

- Provide a copy of your unexpired government photo ID*

- Have a U.S. bank account

Visit the Sharestates Glossary to see the IRS definitions of a U.S. person and a Non-U.S. Person.

If you signed up with Sharestates as a non-accredited investor and have since become accredited, contact us at hello@sharestates.com and we will gladly update your accreditation status for you.

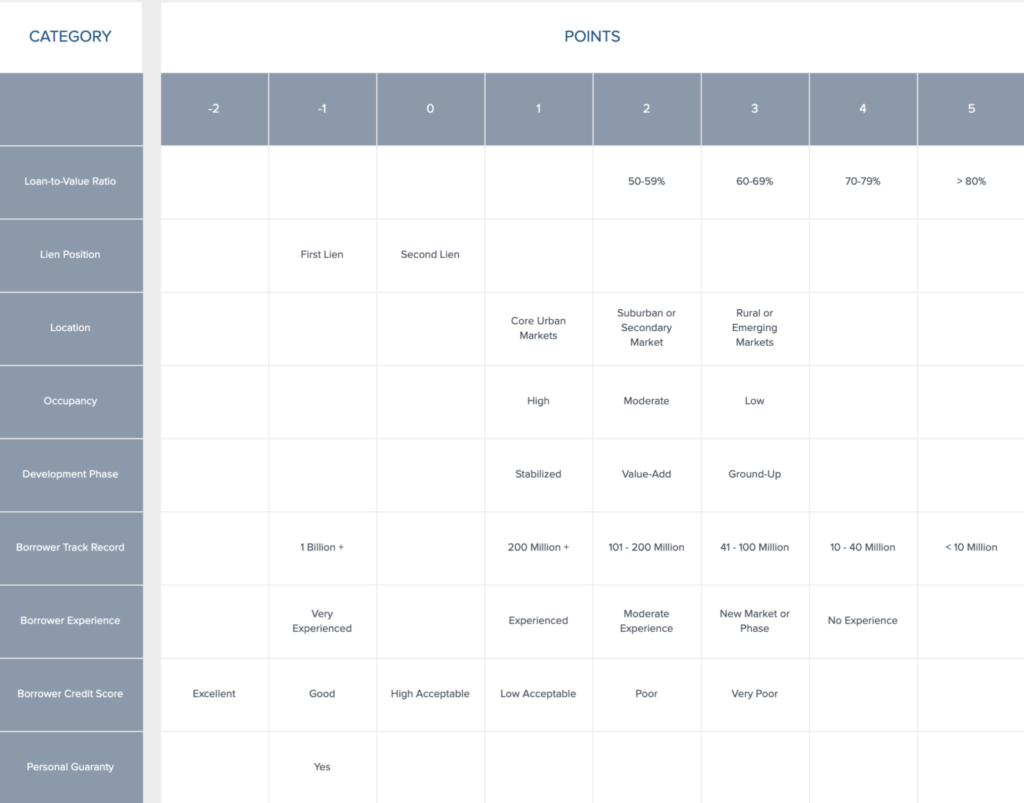

Sharestates puts each real estate investment project through a 34-point underwriting and risk assessment process. The nine underwriting categories we evaluate for each deal are:

- LTV Ratio

- Lien Position

- Location

- Occupancy

- Development Phase

- Sponsor’s Track

- Record

- Sponsor’s Experience

- Sponsor’s Credit

- Score

- Sponsor’s Personal Guarantee

If the real estate project successfully passes the underwriting process, a rating is determined on the deal’s score. Sharestates then determines the project’s suggested interest rate. View our risk matrix above.

Investing in Sharestates’ real estate loans is very simple.

- Go to our Investments page to view our open loans

- Find a project that meets your investment criteria and click/ tap the Invest Now button

- Enter your investment amount and set up your bank account so we can distribute interest and principal

After making your investment, Sharestates will email notifications so you can track your returns and receive property updates through your investor account.

Historically, real estate has outperformed the stock market. That’s why it is considered one of the best alternative asset classes. Real estate investing is not liquid, however, and it does carry some risks, but overall, it has been a good investment for private investors who perform the proper due diligence. We recommend always speaking with your investment advisor about any investment.

Sharestates does not provide investment advice. However, we understand that market forces change over time. In recent years, the stock market has been very volatile. That’s why many investors have sought to diversify their portfolios by seeking alternative asset classes.

Historically, real estate has been a solid investment. According to Investopedia, average 20-year returns for the S&P 500 Index is about 9.5%. Real estate, on the other hand, averages 10.6%. Our crowdfunding platform gives investors access to alternative real estate investments for as little as $5000. Before crowdfunding, investors usually could not participate in these real estate projects for any amount less than 6 figures.

Yes. In common equity projects, private investors make a profit if the project sells for more than it was worth when you invested in it. The net proceeds would then be distributed accordingly to each equity investor based on when and how much they invested. On debt projects, however, investors receive a monthly interest payment and a balloon principal payment at the end of the term. There is no property appreciation for debt projects and investors do not own the underlying property.

Sharestates offers two types of investments: Borrower payment dependent notes (Notes) and Limited Liability Company (LLC) Membership Units. Sharestates Notes are debt securities (notes) directly linked to the performance of a corresponding project investment. The Notes are unsecured special obligations of Sharestates. Our obligation to make payments on the Notes is entirely dependent on Sharestates receiving a payment from the corresponding project investment sponsor.

The projects the sponsors undertake can be renovation, purchase, refinance, or construction of the underlying asset/property and this type of investment is called a ‘real estate debt investment’. Sharestates, through its marketplace, offers investors the opportunity to purchase the notes fractionally – with minimum $5000 per note, or up to the entire note (whole note). When Sponsors make payments on their loans, Sharestates passes those payments on to investors. When Sponsors pay off their loans, investors receive the full payment due to them based on their initial investment.

The second investment type comes in the form of Limited Liability Company (“LLC”) Membership Units. In essence, you will own a piece or slice of the subject property. When you purchase a Membership Unit in an LLC, you’re purchasing rights to a portion of that company. Accordingly, you’ll be entitled to a share of the profits and losses attributable to that company.

Sharestates cannot guarantee any returns, and past returns are not indicative of future returns. However, Sharestates performs stringent due diligence on every project using our 34-point underwriting and risk assessment process. Because each real estate project is structured differently, investors should read all relevant offering materials before investing in projects.

Debt projects deliver monthly interest payments to private investors and a balloon interest payment at maturity. Equity projects vary in structure and each offers its own potential return on investment based on our review of the project. Sharestates performs due diligence on the real estate investment as well as on the borrower, and all relevant information is shared with investors. Some private equity real estate investments deliver returns at the end of the loan term while others provide investors with monthly dividends and a balloon payment upon maturity. It is important for investors to read all offering materials on each project to understand how each real estate project is structured.

Returns on investment can vary. Every real estate investment carries some risk, and it’s possible that investors could lose money. However, Sharestates uses a 34-point underwriting and risk assessment process to vet all our deals. If we aren’t confident in a project or a Sponsor, we don’t offer it to the marketplace. Our real estate investments range from 8-12% expected return on investment.

A preferred return can vary in detail, but the basic idea behind it remains the same. Some project investments will designate a certain percent return as a “preferred return”. In effect, this gives your class of Notes or Membership Units a step up in priority – resulting in distributions first, before a regular equity partner.

A grace period is the amount of time after the due date before penalties are assessed for late payments. Sharestates’ grace period for loans is 10 days.

A past due loan is one where the borrower (Sponsor) has not made a payment when the payment was scheduled. Sharestates does not initiate foreclosure proceedings until a loan has been past due for 90 days, in which case it is considered to be in default.

If a sponsor defaults on a loan, then Sharestates may pursue foreclosure. Any money recovered through foreclosure (after legal expenses) will be distributed accordingly to investors. For a preferred or common equity deal, Sharestates may seek judicial relief for damages.

You may view our loan performance on our Statistics page: https://www.sharestates.com/statistics. A majority of this data is updated every day and anyone may view it without needing to log into the site or request the information.

If a borrower defaults and Sharestates begins the foreclosure process, the time a foreclosure takes generally depends on whether the property is located in a judicial state or non-judicial state. A judicial state means the foreclosure process must go through the court system, which can elongate the foreclosure process. A non-judicial state means that foreclosure process does not have to go through the court system, which generally makes the process quicker.

Judicial States:

Connecticut, Delaware, Florida, Hawaii, Illinois, Indiana, Iowa, Kansas, Kentucky, Louisiana, Maine, New Jersey, New Mexico, New York, North Dakota, Ohio, Oklahoma, Pennsylvania, South Carolina, Vermont, and Wisconsin.

Non-judicial States:

Alabama, Alaska, Arizona, Arkansas, California, Colorado, District of Columbia, Georgia, Idaho, Maryland, Massachusetts, Michigan, Minnesota, Mississippi, Missouri, Montana, Nebraska, Nevada, New Hampshire, New Mexico (sometimes), North Carolina, Oklahoma (unless homeowner requests judicial foreclosure), Oregon, Rhode Island, South Dakota (unless homeowner requests judicial foreclosure), Tennessee, Texas, Utah, Virginia, Washington, West Virginia, and Wyoming.

Unfortunately, there is no secondary market for real estate crowdfunding because the notes and units offered by Sharestates are considered restricted securities. Investors should be prepared to hold them indefinitely or until the loan’s maturity date.

Based on our extensive real estate experience, Sharestates has created a strict 34-point underwriting and risk assessment process offering the best real estate investing opportunities to private investors in all markets. Two of Sharestates’ three principals, Radni and Raymond Davoodi, founded The Atlantis Organization, a provider of title insurance and real estate solutions since 2005 that has done over $1 billion in transactions. The third principal and Sharestates CEO, Allen Shayanfekr, Esq., is the National Title Producer and Account Executive at The Atlantis Organization and holds 28 producer licenses across the U.S. As of December 3, 2020, Sharestates has facilitated over $2.5B million in transaction volume since launching in February 20. As of December 12, 2019, we’ve experienced less than .1% principal loss, an unheard of track record in the real estate crowdfunding industry. Sharestates was also nominated for the Emerging Real Estate Crowdfunding Award at the largest industry conference in the U.S., LendIt USA 2017.

Sharestates’ online platform uses SSL protection, advanced firewalls, automatic logout, and FDIC-insured escrow accounts to pool investor funds. We take security seriously because we want to earn our customers’ trust, and we believe that trust is the foundation of strong, long-term relationships.

Sharestates uses the highest website security encryption standards among marketplace lenders. That’s why real estate developers continue to use our platform for raising real estate capital and private investors use us for building real estate wealth and growing passive income through real estate investing.

As of June 2018, we recorded over $1 billion in loan originations since launching in February 2015. That makes us one of the fastest growing real estate crowdfunding platforms online and also one of the largest. We’ve also been nominated as a LendIt Conference Industry Award finalist for the Emerging Real Estate Platform category award.

These achievements signify we are well-respected among industry peers and non-industry professionals alike.

In the unlikely event that Sharestates were to go out of business, investors are protected. Sharestates uses a remote bankruptcy structure to safeguard private investor assets. A secondary service provider would be appointed to service any outstanding crowdfunded projects. The real estate investments are made through special purpose entities that are restricted from taking on any form of debt not related to the corresponding projects.

REITs are blind pools of investment properties with little transparency and generally carry high fees. Public REITs are traded like stocks and are therefore subject to the volatility of the market. In addition, REITs do not offer a debt product. As a private investor with Sharestates, you have total control over your money and your investments. Plus, there is inherent transparency with every deal. You choose which real estate projects to fund and how much you invest on each project. Sharestates’ fees are lower than traditional investment fees, and you get the same stability offered through traditional real estate investing.

Additionally, there are several tax treatment differences between real estate investing through Sharestates and REITs.

Consult your professional tax preparation service for a better understanding of the tax treatments related to our investments.

A defaulted loan is one in which the borrower has not made a payment in 90 days. In the case of a defaulted loan, Sharestates will work with the borrower to secure payment. If a payment is not forthcoming, Sharestates will begin foreclosure proceedings.

Sharestates will distribute any collected default interest to investors. Default interest starts accruing when a loan becomes default (60+ days past due) at a rate of 23.99%.

Sharestates does not share extension fees or late fees.

Please note that Sharestates may waive fees in order to bring the loan current, support the borrower’s ability to complete the project, and therefore better protect investor principal.

Yes, Sharestates is open to foreign investors (also known as “non-U.S. persons”). To be eligible to invest as a non-U.S. person, you must

- Complete a W-8BEN (for an individual) or W-8BEN-E (for entities) form*

- Provide a copy of your unexpired government photo ID*

- Have a U.S. bank account

*Please email these documents to investors@sharestates.com.

Visit the Sharestates Glossary to see the IRS definitions of a U.S. person and a Non-U.S. Person.

All foreign investors are able to invest in loans from Sharestates, except for foreign nationals from North Korea, Iran, Iraq, Somalia, Sudan, Nigeria* (only remittances), Yemen and Syria.

Each investor should consult their own tax advisor. Sharestates does not provide tax or legal advice.

For U.S. accredited investors, Sharestates does not withhold tax on the investor’s behalf. Furthermore, non-U.S. persons are exempt from this requirement if they fill out the proper forms. These forms notify Sharestates that such investors are not U.S. persons and therefore not subject to tax withholding.

Learn more about how investing works at Sharestates

Our centralized platform brings investors, borrower, and real estate experts together

We have answers for you

Take a look at what others are asking and how we can provide the information you need to help you get started.

Get started with as little as $5,000

Partner with us today and let your money start doing the work for you.