Key Takeaways:

• The shortage of homes paired with intense consumer demand for suburban single-family homes leads to single-family asset prices increasing tremendously.

• SFR rent growth provides better ROI than peer asset classes.

COVID’s impact on the Market

Covid impacted the housing market at a disproportionate level—ultimately creating big winners and big losers. Of course, the housing market is a very general term and we must define the segment of interest. The single family market turned out to be triumphant due to the numerous number of people fleeing major cities in hopes of finding suburban homes. As mentioned in 2021 Multifamily Market Outlook: First Quarter written by yours truly, “vacancy rates in the suburban multifamily market have declined…areas like Long Island and the suburbs of New Jersey seemed to be the biggest winners here… government aid certainly helped people expand their supply of cash along with a decrease in consumer spending (at least in the beginning portion of the pandemic)…consumers are able to spend more and for a longer duration.” What does this mean? To put it simply, because the onset of Covid forced everyone to stop production, home development halted immediately. Ultimately, creating a shortage of homes. The shortage of homes paired with intense consumer demand for suburban single-family homes lead to single-family asset prices increasing tremendously. According to CoreLogic, “home prices continued to increase in February, reaching the highest annual gain since April 2006.”

Is a Housing Bubble on the Horizon?

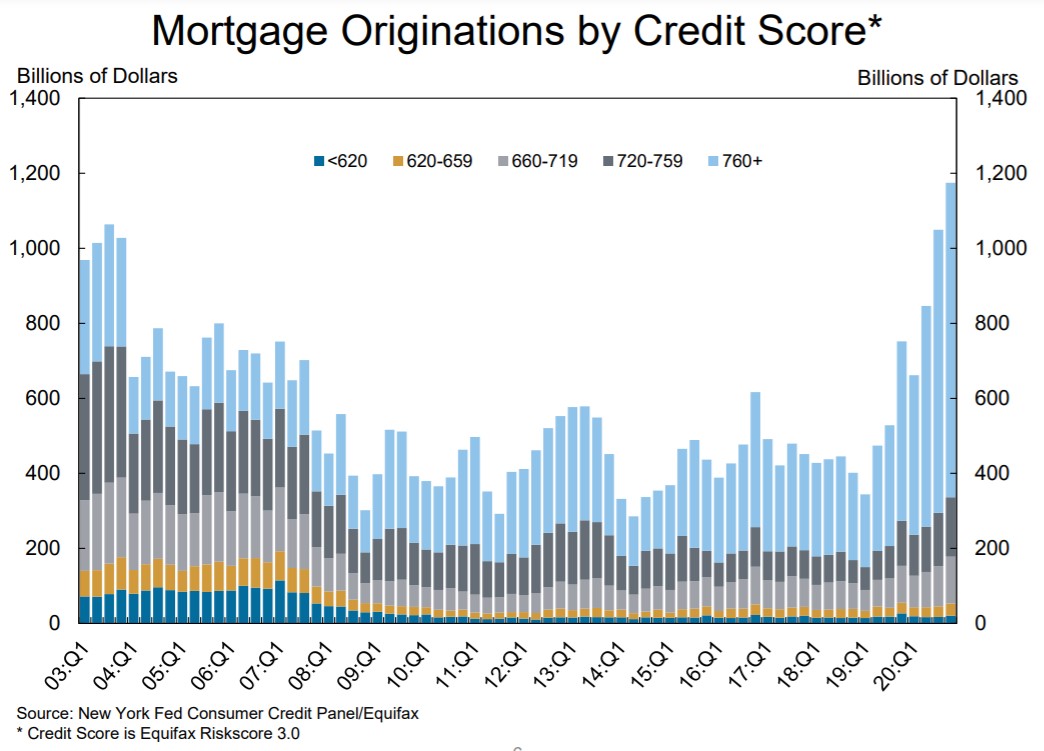

It is natural to think that we are approaching a housing bubble similar to that of 2006-2008. Asset prices in the single and multi-family home sectors have been climbing since the onset of the pandemic. However, Ben Carlson, CFA from A Wealth of Common Sense argues that in this case, history will not repeat itself. Carlson states that more loan originations are being made for higher credit borrowers which was the exact opposite of the subprime boom. Notice the sharp trend upward of higher creditworthy borrowers compared to ’07 levels.

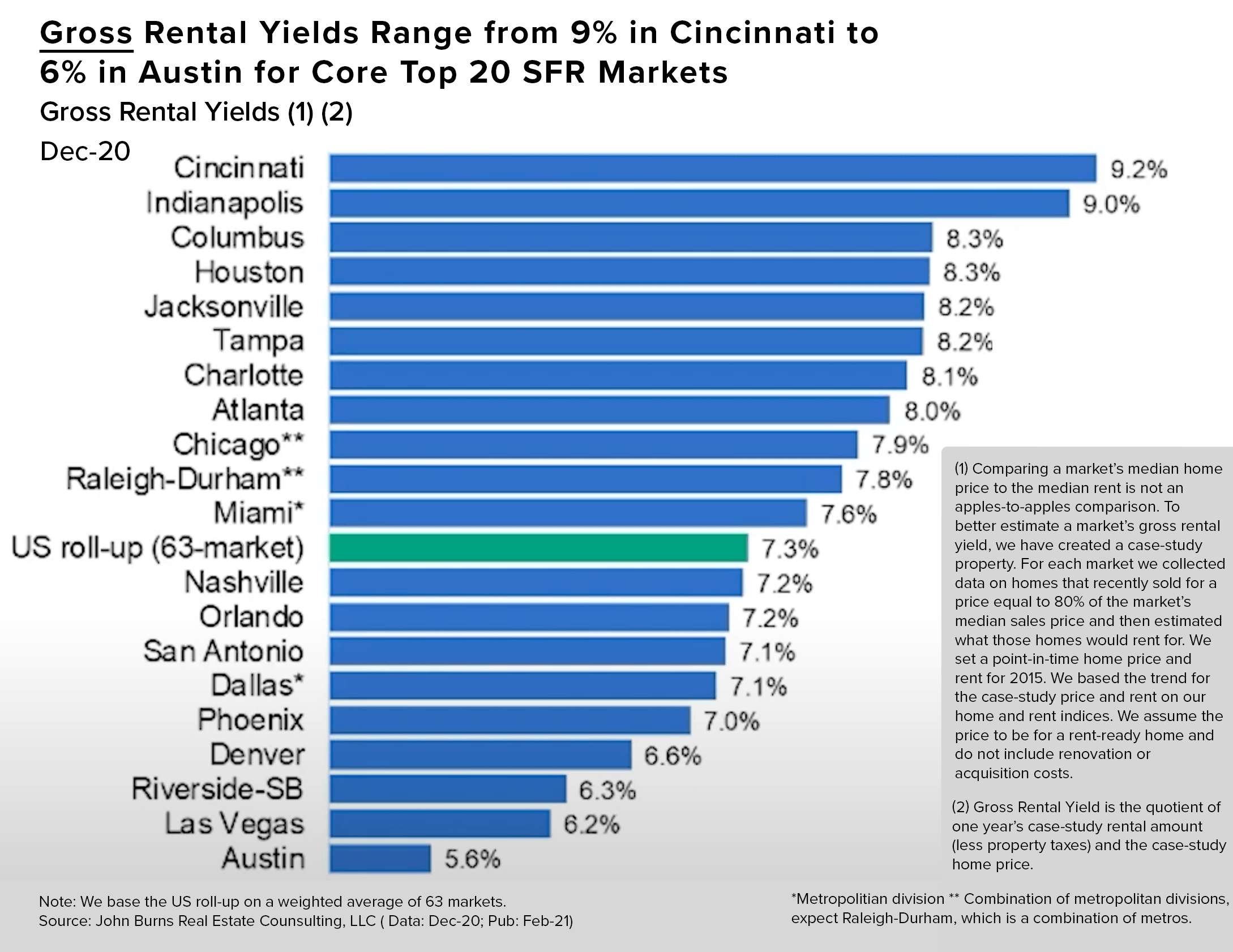

As far as cap rates are concerned, apartments in the major cities used to be in the low single digits but rose drastically as people fled, causing demand and prices to fall respectively. We may see somewhat of a normalization of cap rates in major cities but they won’t be at levels we were used to. It is not surprising that investors are staying away from NYC loans, especially ground up in the near term. NYC apartment cap rates for the longest time suggested a safer return on investment. However, we ultimately saw a reversal in the sense that suburban asset cap rates declined while city cap rates increased. This is why single family homes continue to outperform. According to Altus Group, “another advantage [of SFR] is that tenants tend to renew their releases which results in lower turnover costs… SFR’s have a 70% retention rate.” Even during the ’08 crisis, when home prices decreased, “SFR rent growth diminished but never went negative… owners can capitalize on this by refinancing or selling and realizing the gain.”

As John Burns, Chief Executive Officer of John Burns Real Estate Consulting stated in a presentation titled The Single Family Rental Boom is on the Horizon hosted by Berkadia on April 14th, “home renters prefer a single family lifestyle to an apartment lifestyle.” Simply put, consumer preferences dictate market trends. Thus, when more consumers demand more bedrooms, more privacy and more yard space, single family demand and subsequently price will rise accordingly. Also, interesting to note, is that more single family home communities are being developed. Areas such as Florida have been seeing a lot more ground up community style projects that are built for people to purchase. These gated communities tend to be for adults averaging above the age of 55 and offer plenty of amenities such as shopping centers, schools, banks, dog parks, pools, golf courses, etc. The graph below shows rent growth by city. Notice how Jacksonville is going strong, with Tampa on par.

Sharestates and Single Family Investing

The Sharestates Trading Desk has already been receiving plenty of promising ground up deals in communities similar to those in Jacksonville and Tampa. We can expect more to come as consumers look for more affordable options that offer local and community-based amenities. As Sharestates’ very own Alison Hoffman stated in a prior post titled South Florida Real Estate Performance, “South Florida’s real estate resurgence has all the signs of a boom that’s here to stay for a while as the country’s other major metropolises like Manhattan and San Francisco struggle with long-term re-pricing.” In addition, “there’s an influx of European and South American buyers… competing with local buyers who are moving from urban high rises to the suburbs.” Many single family properties are also in the process of renovation which will result in higher property values, further bolstering confidence in the single family housing market.

To view Sharestates’ open real estate investments create an account here.