Whether you’re presently managing one or more rental properties or considering purchasing rental properties, this article provides a list of ways to maximize your profit and, along the way, simplify your management challenges.

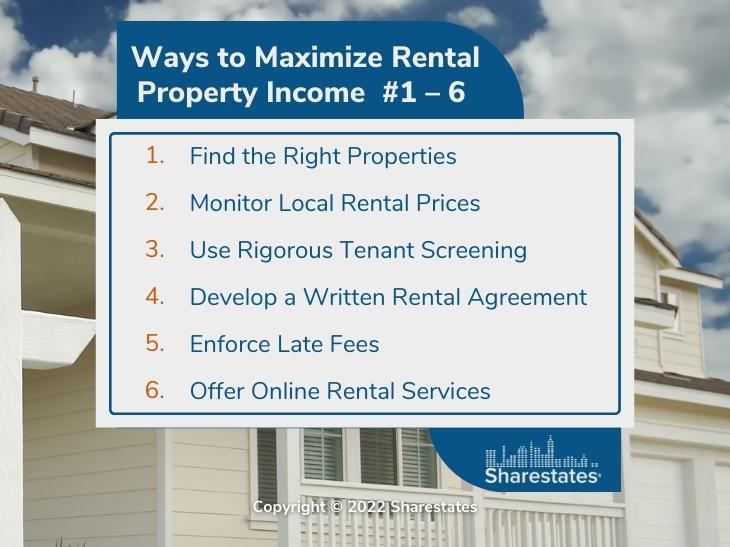

1 – Find the Right Properties

While your potential rental properties might not be in the Top 10 Rental Markets we’ve identified, the big market keys are job growth, population growth, and affordability. Those factors will help with profitability, but you must also look for safe neighborhoods, convenient local services, and proximity to growing employers. As with any real estate investment, it’s almost always about location.

2 – Monitor Local Rental Prices

Part of finding suitable properties is determining if the market rental rates will support your investment. They need to be affordable to attract tenants, but they also need to provide profitability. Of course, once you’ve invested, the rental prices do not remain static. You’ll need to regularly review local prices and respond with needed adjustments to ensure you’re staying competitive and maximizing your return.

3 – Use Rigorous Tenant Screening

The one risk with rental properties is vacancies. That’s closely followed by tenants that aren’t paying their rent and damaging the property. Tenant screening is the first step you can take to head off these two significant risks. The critical elements of tenant screening are credit score, criminal background checks, rental history verification, and monthly income verification. Don’t short circuit this step just to get someone into your rental property.

4 – Develop a Written Rental Agreement

The rental agreement sets the stage for everything that follows in your tenant relationship. It also helps avoid expensive legal battles if things go wrong. It needs to cover prices, late fees, rules, expectations about paying for damages, who pays utilities, and more. Don’t scrimp on this task, and for sure, don’t rely on verbal agreements.

5 – Enforce Late Fees

Part of the written rental agreement should be the amount and timing of late fees. Make sure you enforce and collect these fees. It can be all too easy to understand why a payment is late, but that momentary generosity can lead to other rules violations. It also means you’re on the hook for mortgage payments while waiting for the overdue rental payment.

6 – Offer Online Rental Services

Many administrative tasks for your rental properties can be taken care of using online systems. That includes applications, tenant screening, payments, assessing late fees, and alerting you to needed repairs. This can simplify the rental management process, provide better service to your tenants, and insert the online system between you and the tenant when it comes to collecting late fees, etc. It can be well worth the investment. It’s also something that’s expected by this online generation.

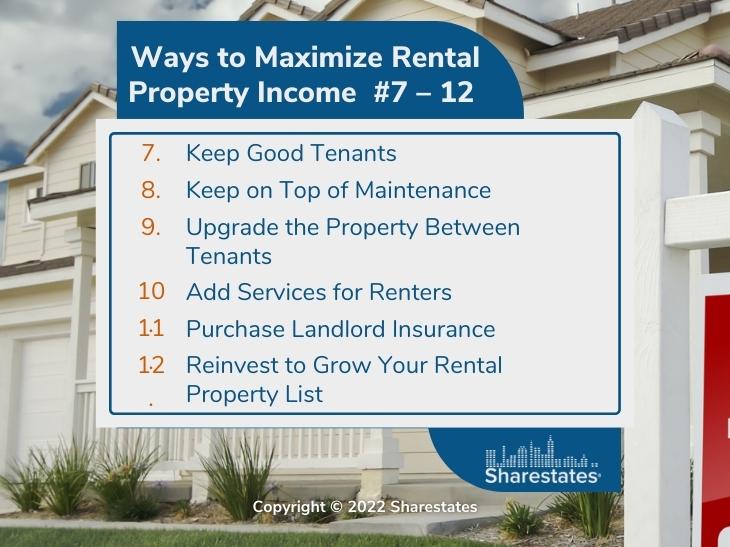

7 – Keep Good Tenants

You’ve spent a lot of time and effort to find good tenants. Once they’re renters and have proven their value, you don’t want to lose them. Even a month’s vacancy can put a significant dent in your profits. That means it’s wise to offer renewal agreements to existing good tenants. Consider offering a renewal 90 days before the current agreement expires. This is also an excellent time to determine if the rental price should increase to match market conditions.

8 – Keep on Top of Maintenance

Those calls in the middle of the night about a leak or clogged sink can be a real pain. That’s one reason to conduct regular maintenance and promptly fix any problems encountered. That prevents problems from growing into significant damage to your properties. It also keeps your tenants happy. Plus, when the rental property does turn over, you’ll have less work preparing it for the next client.

9 – Upgrade the Property Between Tenants

This is an ideal time to make some upgrades to the property. That includes painting, cleaning or replacing carpets, and even significant upgrades. The most beneficial areas for upgrades are kitchens and baths. Cleaning or replacing appliances and updating showers and fixtures can make a real difference in attracting the next tenant. Plus, it can head off future maintenance issues.

10 – Add Services for Renters

You have a captive market for additional services within a rental property, particularly multi-family properties. Providing a coin-operated laundry and extra storage space for renters can provide excellent service and additional income. There may be many other options depending on your tenants and property.

11 – Purchase Landlord Insurance

Your personal homeowner’s insurance will not provide the needed coverage for your rental properties. The coverage should include liability for accidents and injury, fire, flooding, and weather damage. Landlord insurance is the best protection for your properties and your business.

12 – Reinvest to Grow Your Rental Property List

Another way to maximize profit is to expand your rental property holdings. That means buying more properties. An additional approach is selling your lowest-performing property and buying a better one. This is also where you can apply all you’ve learned in managing your current properties to finding and growing new properties. See our Guide to Private Real Estate Loans for insight into financing options. Among the options, term loans are particularly appropriate for rental properties.

We hope this overview of maximizing profit on rental properties has helped you gain further insight into some best practices.

Click here to learn more about obtaining funding for your rental property business through Sharestates.