In this article, we cover bridge financing and term loans. That includes definitions, pros, cons, and when to use each type of loan.

Bridge Financing Defined

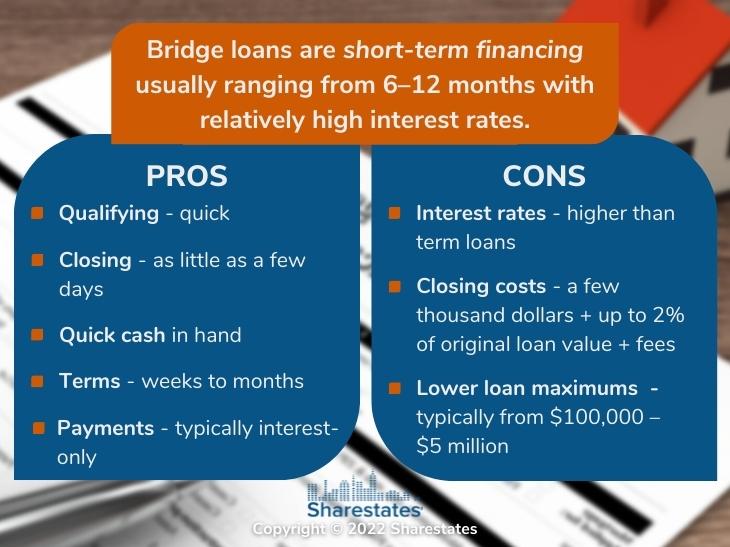

Bridge loans are short-term financing usually ranging from six to 12 months with relatively high-interest rates. They are used to bridge one form of financing to another over the short term. That includes bridging the gap between a construction loan and a new mortgage. They can also be used to secure funding for the time needed to fix and flip a real estate investment property.

A hard money bridge loan is a short-term loan with real estate used as collateral. This approach allows those with lower credit ratings to still obtain the financing they need.

We’ve highlighted the pros and cons of bridge financing below.

Bridge Financing Pros

- Qualifying is quick, often with same-day approval.

- Closing can happen in as little as a few days.

- Quick cash in hand for your project.

- Terms can range from weeks to months and more typically six, 12, 18, or 24 months.

- Payments are typically interest-only during the period of the loan.

Bridge Financing Cons

- Higher interest rates than term loans.

- Closing costs are usually a few thousand dollars, plus up to two percent of the loan’s original value. There are also origination and other fees.

- Lower loan maximums, typically ranging from $100,000 minimum to $5 million maximum.

When to Use Bridge Financing

As noted above, bridge loans can be used to cover the gap between a construction loan and a new mortgage. They are also used to provide a down payment on a new home while waiting for the current home to be sold. They can further be used to cover operating expenses while waiting for long-term financing, to quickly acquire real estate, and to buy out a partnership.

Term Loans Defined

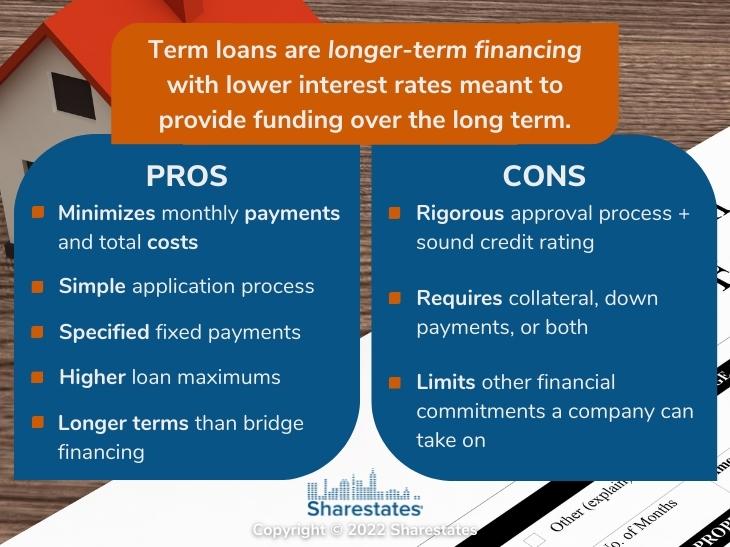

Most are familiar with term loans. A fixed-rate 30-year home mortgage is a term loan. They are longer-term financing with lower interest rates than bridge loans, often near prime rates. They are meant to provide real estate funding over the long term with regular monthly or quarterly payments.

Term loans work best for established businesses with sound finances, excellent credit ratings, and who can provide down payments, collateral, or both. They also bring the flexibility of short and intermediate-term loans. These require payments of interest only through the term of the loan with the full principal paid at the end. They are also known as balloon loans.

We’ve highlighted the pros and cons of term loans below.

Term Loan Pros

- Minimizes monthly loan payments and total loan costs.

- Simple application process.

- Specified fixed payments.

- Higher loan maximum amounts.

- Far longer terms than bridge financing.

Term Loan Cons

- Requires a rigorous approval process and sound credit rating.

- Requires collateral, down payments, or both.

- Limits the other financial commitments a company can take on.

When to Use Term Loans

Term loans are typically used for long-term investments including purchases of machinery, construction, and property investments. They can also be used to provide the operating cash needed for month-to-month business operations.

We hope this brief analysis has helped provide insight into bridge financing and term loans. To learn more about getting funding for your business through Sharestates, click here.