Building your own home offers plenty of rewards, from making your own space to ensuring everything is done right from the start. But it also requires financing that matches the needs of the project. That comes from a construction loan.

This article examines construction loans, the types available, requirements, and what to ask a potential lender to find the best loan for your construction project.

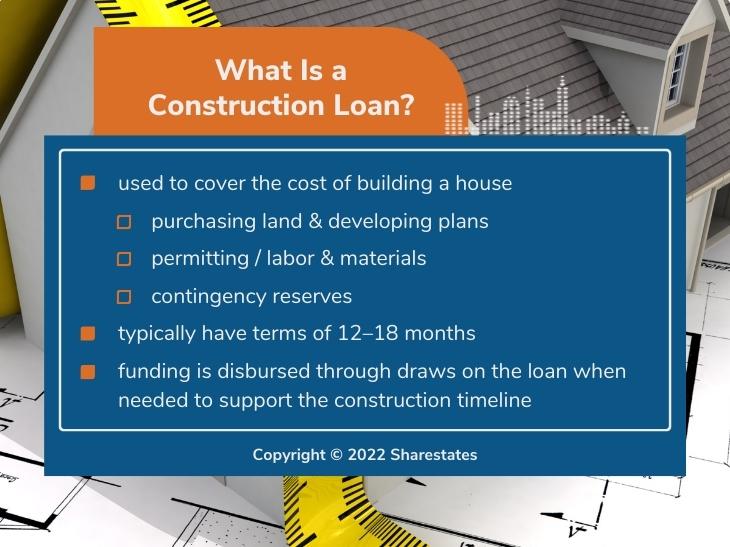

What Is a Construction Loan?

A construction loan is used to cover the cost of building a house. It includes purchasing the land, developing plans, permitting, labor, materials, and contingency reserves. They typically have terms that extend through the building process, 12 to 18 months.

Since there is no completed house to serve as collateral for the loan, the approval process looks more closely at the planning for the project, including the timeline and budget and the borrower’s financial situation. Plus, funding will be disbursed through draws on the loan when needed to support the construction timeline. That could also mean the lender must evaluate the construction status through an inspection before authorizing the payment. That means the construction loan is more of a line of credit.

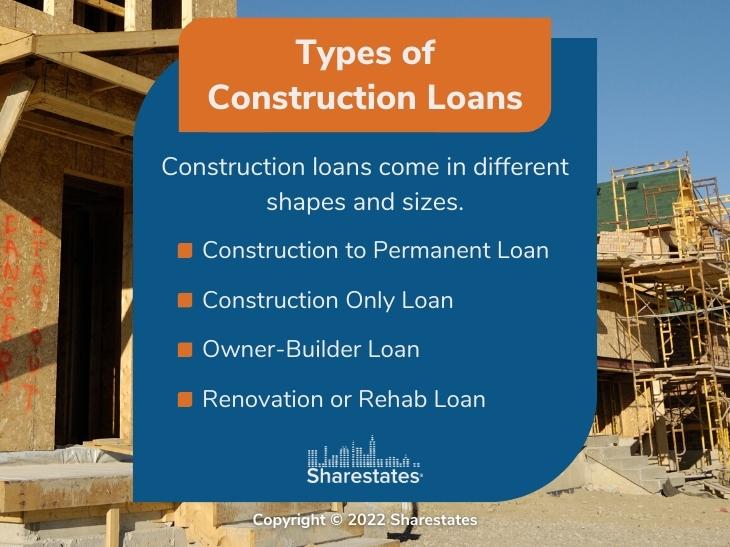

Types of Construction Loans

Construction loans come in a few different shapes and sizes. Here’s a brief overview.

- Construction to Permanent Loan. This loan is essentially a two-in-one type of loan. It first finances the construction of the home. Then, second, on completion of the home converts to a fixed-rate mortgage. This saves on closing costs and locks in a mortgage rate at the start of the project.

- Construction Only Loan. This is a short-term adjustable-rate loan used for construction only. It must be paid in full or refinanced at the end of the construction project. This requires two closings but may be suitable for those selling their primary residence to pay off the construction loan.

- Owner-Builder Loan. These loans are designed for an owner who is also an experienced homebuilder, usually with a contractor’s license. With this type of loan, the draws on the loan are paid to the owner-builder rather than a third-party contractor.

- Renovation or Rehab Loan. These loans cover the costs of purchasing a home and renovating the house. They are primarily for fixer-uppers with the loan amount based on the after-repair value (ARV). These loans are FHA 203(k) and Fannie Mae HomeStyle loans. See our article on the types of rehab loans for more information.

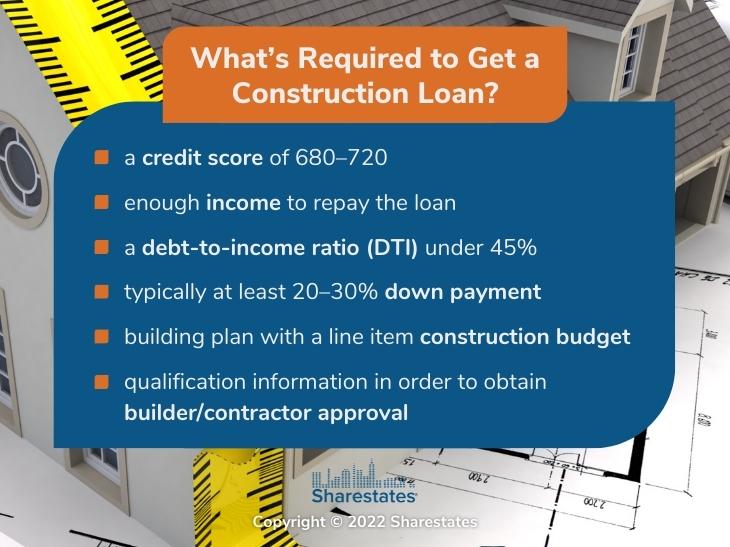

What’s Required to Get a Construction Loan?

As noted earlier, since there’s no house to serve as collateral, a construction loan approval process primarily looks at the borrower, their credit history, and the project itself. Here are the key items you’ll need to provide the lender.

- Credit Score. Lenders typically require a minimum credit score of 680 for a construction loan. But some require at least 720. So it’s best to improve your credit score before applying.

- Income. A key criterion is that you have enough income to repay the loan. You’ll need to provide documentation of your annual income and that it exceeds your current debt, as well as the requested construction loan.

- Debt-to-Income Ratio (DTI). This ratio is all your monthly debt payments compared to your gross monthly income. Lenders usually require a ratio under 45% for construction loans. It’s all about determining your ability to repay the construction loan.

- Down Payment. The amount of the required down payment depends on the lender. It is typically at least 20% and can be as high as 30%.

- Construction Budget. A well-thought-out building plan is a must for any project. It’s essential for a lender when sizing up all the risks associated with providing a loan. Ideally, you’ll provide drawings, specifications, line item budget, draw schedule, construction contract, and land deed or purchase agreement. The more you can provide, the better it will be for any loan officer, along with a more likely approval.

- Builder/Contractor Approval. The builder or general contractor’s qualifications, licensing, and insurance coverage are critical to ensure that the construction will be done correctly, on time, and within budget. You’ll need to provide all this information to support your proposed project.

Questions to Ask Construction Lenders

It’s wise to be prepared for any questions a lender may have as you submit your construction loan application. But it’s also sound business practice to have your own list of questions for the lender. You’ll not only learn more about the lending process and what’s expected of you, but you’ll also be demonstrating that you’re a serious businessperson. Plus, it’s crucial to select the lender that can provide the best terms, rates, and down payment requirements. Here’s a starting list of questions.

- What types of construction loans are available?

- Can the land serve as equity for the construction loan?

- What are your interest rates for fixed and adjustable-rate loans?

- What are the closing costs and fees?

- How and when are construction draws paid?

- Do you require inspections before construction draws are paid?

- What are the options if we encounter delays during the construction?

- If costs increase, what options are available to increase the loan amount?

- What timeframe is required for closing and disbursement of the first draw?

You’ve got questions; we’ve got answers.

That’s where Sharestates can help. We’ve provided a brief guide to private real estate loans. It includes details on what you need to do to secure a private loan. You can also review our article on the pros and cons of private real estate loans.

Click here to learn more about funding for your fix and flip business through Sharestates.